A golden nugget of wisdom we should add to the likes of "fire cannot melt steel," and "Al Qaeda isn't in Iraq," should be "gas prices are set by Hallibuton and Republican donors to pay pension plans."

I can't help but remember, the indispensable Tom Sowell said, "Asking a liberal where prices and wages come from is like asking a six-year-old where babies come from."

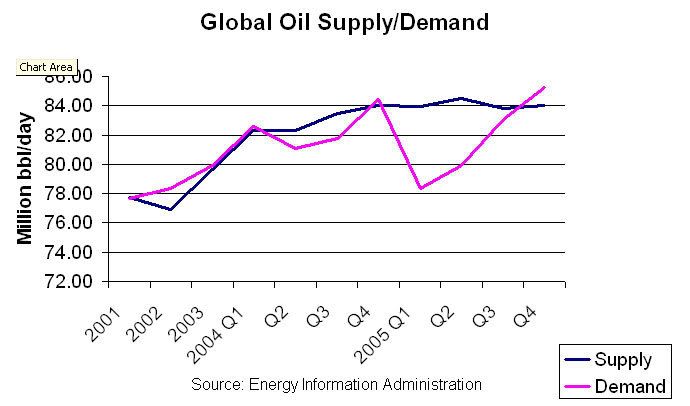

As usual, the current gasoline prices are directly correlated to an increasing demand without an increase in supply that would be necessary to maintain the same price. No congressman's bill entitled, "The 2007 Act to Repeal Economic Equilibrium and to Henceforth Draw Demand Curves Upside Down" will change that.

The Wall Street Journal explained it well this morning:

Under the anti-gouging law, service station owners could face up to 10 years in prison if they dare to raise their prices too much when supplies are low. Representative Bart Stupak, the Michigan Democrat who sponsored this scheme, said the vote would determine whether Members "side with Big Oil" or "side with consumers who are being ripped off at the gas pump." Who elects these guys?

The inconvenient fact is that there's no evidence of price rigging by Big Oil or the tens of thousands of independent service station owners across America. The causes of higher gas prices include $65-a-barrel oil caused by rising global demand and geopolitical tensions, a record high U.S. gasoline consumption of 380 million gallons a day, and refined gasoline shortages caused by Congressional rules and mandates. Far from withholding production to raise prices, U.S. gasoline production of 8.8 million barrels a day is higher than any time in history and refineries are getting more gas per barrel of oil than ever before.

It's worth noting what the Federal Trade Commission (FTC) report on oil prices released last year, "Investigation of Gasoline Price Manipulation and Post-Katrina Gasoline Price Increases," had to say regarding prices.

"In light of the amount of crude oil production and refining capacity knocked out by Katrina and Rita, the sizes of the post-hurricane price increases were approximately what would be predicted by the standard supply and demand paradigm that presumes a market is performing competitively... olding prices too low for too long in the face of temporary supply problems risks distorting the price signal that ultimately will ameliorate the problem."

Instead of price controls, which consistently backfire, there are a couple of options. We can work with the elasticity of oil supply and demand by increasing supply or reducing demand. Nearly all measures to reduce demand have severe economic consequences, so we work to increase petroleum supply and refining capabilities. Kenneth Green from the American Enterprise Institute (AEI) gives some very practical suggestions.

-Open ANWR (sixteen billion barrels of oil)

-Open OCS (billions more barrels)

-Offshore Drilling (same story)

-Repeal regulations on oil refining

I might add, "quit demonizing oil companies." Am I now a suck up?

No comments:

Post a Comment